In light of prevailing economic realities, Singapore has recalibrated its 2023 growth projections downward, as unveiled in official data released on Thursday. The revised growth rate now stands at 1.1%, slightly below the earlier estimate of 1.2%. The fourth-quarter performance, exhibiting a year-on-year growth of 2.2%, fell shy of the government’s initial projection of 2.8%, primarily attributed to a downturn in manufacturing activity. The Ministry of Trade and Industry has issued a cautionary note regarding “significant” downside risks looming in the global economy, citing concerns such as the potential escalation of the Israel-Hamas conflict or the War in Ukraine.

The deceleration of Singapore’s economy is perceived as an integral facet of the global economic slowdown, which is casting a shadow over numerous major world economies. Although authorities characterize it as potentially shallow or technical, their confidence does not translate into clear solutions. Given Singapore’s economy’s high susceptibility to global trends, a slowdown is deemed expected. Despite some positive indicators, such as a decrease in unemployment, experts are forecasting a recession in the United States by mid-2024. The United Kingdom, grappling with a contraction of 0.3% in the final three months of 2023, is officially in recession, marking the conclusion of a dismal year with overall growth at just 0.1%—its weakest performance outside the Covid pandemic year of 2020 since 2009.

Japan, once a competitor for the US economy in terms of growth, has surrendered its third position to Germany and finds itself in a recession, disclosed in data released on Thursday. This comes as Japan confronts challenges like a weak yen and a declining, aging population. While Japan’s economy grew 1.9% in nominal terms in 2023, making it the fourth-largest globally, its GDP in dollar terms stands at $4.2tn compared to Germany’s $4.5tn. Both countries share similarities such as being resource-poor, having aging populations, and heavy reliance on exports. Germany, Europe’s largest economy, is grappling with rising energy prices from Russia’s conflict in Ukraine, increasing interest rates in the eurozone, and a persistent shortage of skilled labor.

Even China, with a faster-growing economy than the United States, is experiencing substantial pressure. Its stock markets have recently been among the world’s worst performers due to concerns about a sluggish economic recovery and challenges in the property sector. The global economic landscape appears increasingly complex and interlinked, with various nations navigating unique challenges amid the broader slowdown.

In 2023, the main catalyst for Singapore’s economic growth emerged from the “other services industries,” showcasing a robust 3.9% year-on-year expansion. The Ministry of Trade and Industry highlighted positive contributions from the information and communications, as well as the transportation and storage sectors. Noteworthy is that all sectors, barring manufacturing, exhibited full-year expansions. Despite a contraction of 4.3% in the manufacturing sector, the construction industry in Singapore thrived, experiencing a notable growth of 5.2% throughout 2023. The information and communications sector demonstrated a year-on-year growth of 4.7%, slightly slower than the preceding quarter, while the finance and insurance sector witnessed a substantial increase of 5.4%, surpassing the 2.5% growth observed in the previous quarter.

Peering into the horizon of 2024, Singapore upholds a growth projection ranging from 1% to 3%, foreseeing a gradual resurgence in manufacturing and trade-related sectors harmonizing with the global surge in electronics demand. The anticipated recovery in air travel and tourism is poised to lend additional support to sectors tied to tourism and aviation. Despite a steady external demand outlook for 2024, the Ministry of Trade and Industry underscores prevailing global economic headwinds. Ongoing conflicts in Gaza and Ukraine, coupled with the delayed impacts of monetary tightening, present potential challenges.

In response to the Q4 2023 performance, Barclays has marginally adjusted its 2024 GDP growth forecast, revising it down to 2.7% from the initial estimate of 3.0%. Following the release of the data, the Singapore dollar was observed trading at 1.347 against the U.S. dollar. The Monetary Authority of Singapore (MAS) anticipates a deceleration in core inflation, a pivotal gauge for the central bank, to an average range of 2.5 to 3.5 per cent for 2024, down from the 4.2 per cent recorded in 2023. Reflecting on the uncertainties persisting in both the growth and inflation spheres, MAS Deputy Managing Director Edward Robinson remarked, “There are continuing uncertainties on both the growth and inflation fronts… so the MAS will be monitoring these trends and implications on both inflation and growth. We will review that comprehensively in the next scheduled review in April. Despite the economic landscape, the central bank has maintained its exchange rate-based monetary policy, holding steady for the third consecutive meeting, with inflation lingering as a concern.

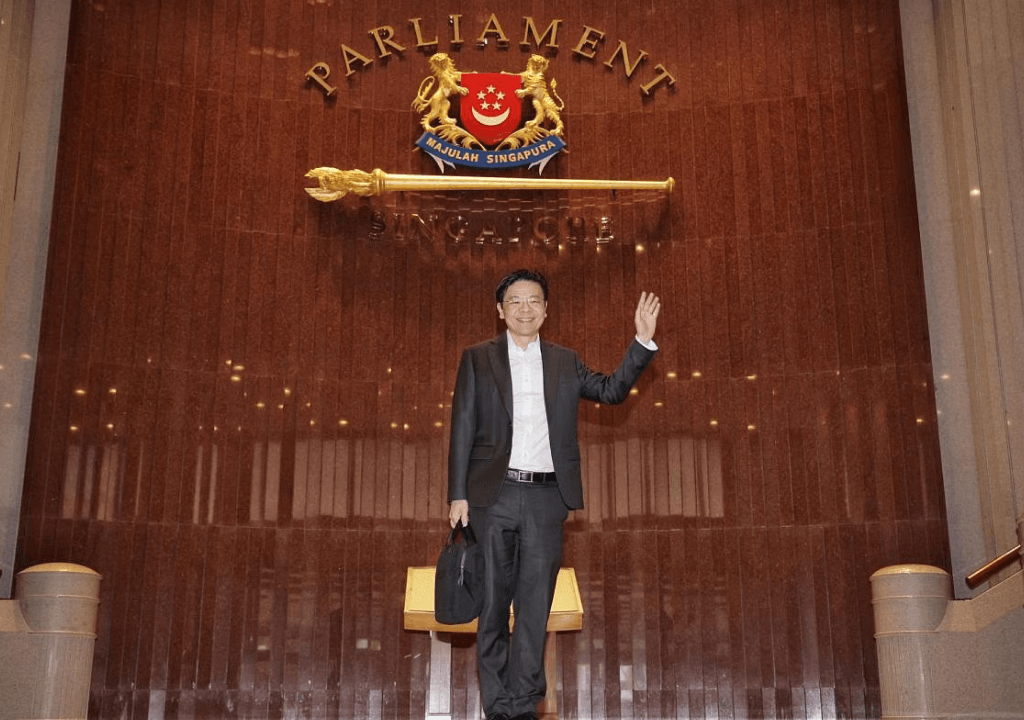

Singaporean politicians perceive the current scenario as opportune for policy enhancements. The slowdown in Western economies and Japan serves as a cautionary tale for Singapore, where the lowest birth rate and a dearth of skilled workers are seen as the root of the problem in deceleration. The Singaporean government recognizes the need to address these issues, and as the spotlight turns toward foreign nations, India emerges as a rising star while others express apprehension. Projections indicate that India is poised to secure the third position within the next two or three years. Currently experiencing a robust growth rate exceeding 7%, India’s fifth-largest economy expanded by 7.6% in the July-September quarter, propelled by government spending and manufacturing. Singapore needs to formulate policies that align with the trajectories of India and other emerging economies.