The Quiet Rise of a New Partnership: Brazil and China Deepen Their Bond

Brazil and China are deepening their bilateral ties, with growing trade, diplomatic cooperation, and shared ambitions in the Global South.

Brazil and China are deepening their bilateral ties, with growing trade, diplomatic cooperation, and shared ambitions in the Global South.

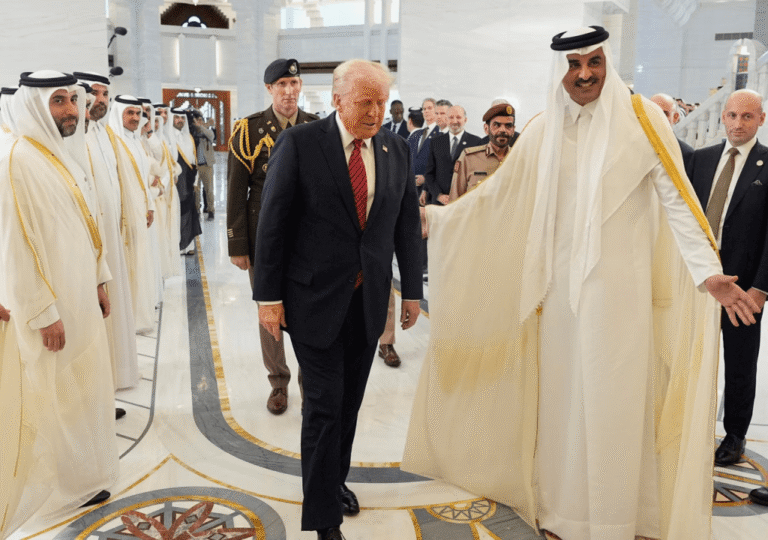

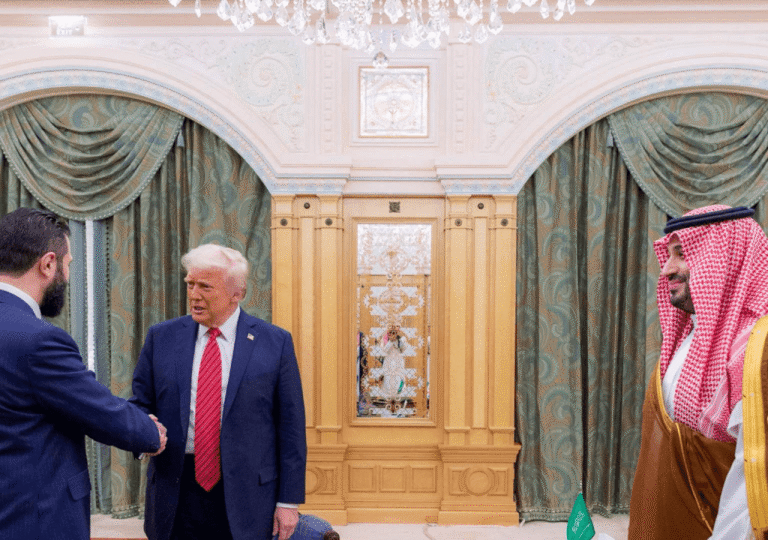

Donald Trump deepens U.S. relations with wealthy Gulf nations through high-profile arms and tech deals, positioning Saudi Arabia, the UAE, and Qatar as key strategic partners.

After lifting U.S. sanctions, Donald Trump met Syria’s new Islamist president Ahmed al-Sharaa in a high-profile summit. Explore the strategic motives and implications behind this unexpected diplomatic shift.

The US China tariff war is on pause, offering some relief to global markets. Yet behind the optimism, both sides remain wary as deeper issues go unresolved.

After the Samarkand summit, the EU eyes Central Asia’s minerals and energy, but will infrastructure, politics, and Russia’s dominance block Europe’s ambitions?

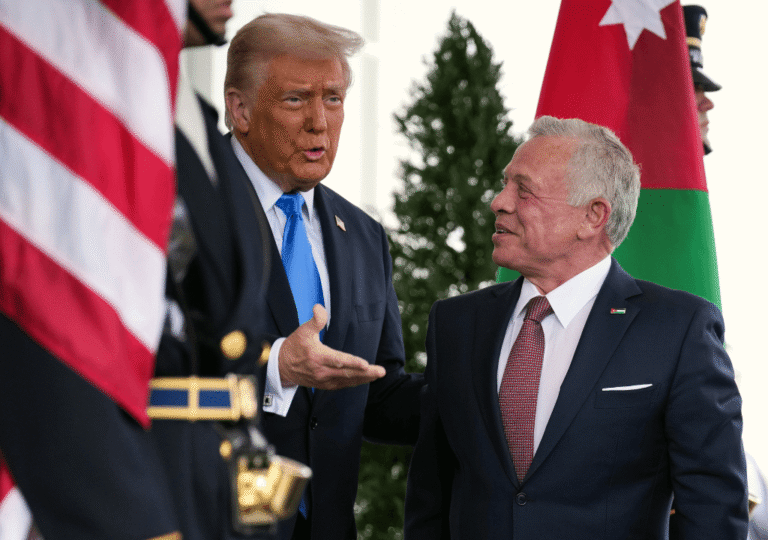

Trump’s and Arab counterplans for Gaza are no longer relevant as Israel moves forward with its decision to seize the territory. Discover the shifting dynamics of Gaza's future.

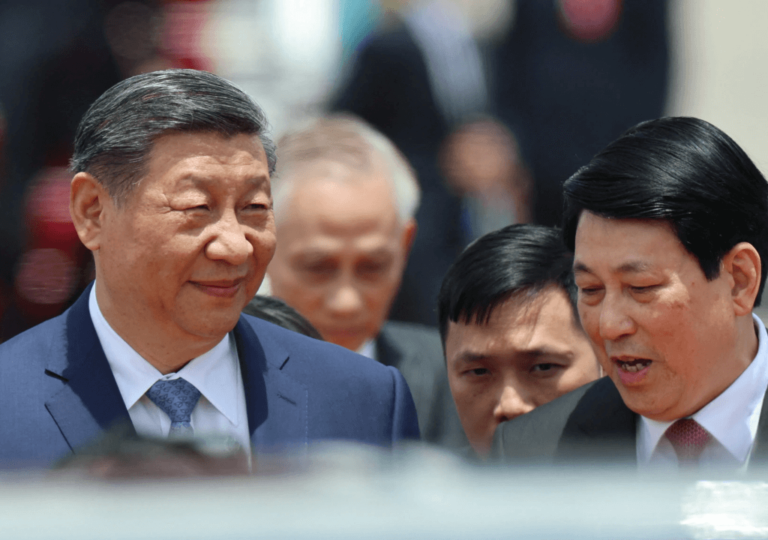

As Xi Jinping deepens ties in Southeast Asia, ASEAN nations quietly navigate trade diplomacy—still hoping toward the U.S. amid rising China-U.S. tariff tensions.

Positive signals emerge after the first round of US-Iran nuclear talks in 2025. Is a new agreement finally within reach after years of deadlock?

As Trump's tariffs escalate, China resists pressure, seeks new trade alliances, and signals it won't back down in the deepening US-China trade conflict.

Israel's Knesset has passed a law to increase political control over the judiciary, drawing protests and marking a significant shift in the balance of power.