Europe has finally taken action to shield its market from the influx of cheap products that have devastated its industries. European-made goods have struggled due to fierce competition from high-quality U.S. and Japanese products, as well as the low prices of Chinese goods in the global market. Despite its high purchasing power, Europe has faced challenges in protecting its own domestic market. Consequently, European powerhouses have been overshadowed by producer countries, resulting in the closure of domestic industries, job losses, and deteriorating living conditions. These problems have fueled the rise of far-right movements, which pose a threat to the stability of the European Union.

Though belated, Europe has started to act to restrict cheap and technologically advanced Chinese products to protect its domestic businesses, launching investigations that could lead to higher tariffs. At the same time, China, the target of Europe’s actions, is facing its own setbacks from declining demand following similar strategies implemented by the U.S. and its allies. In response, China has begun to counter Europe’s actions with its own investigations, mirroring the European Union’s tactics.

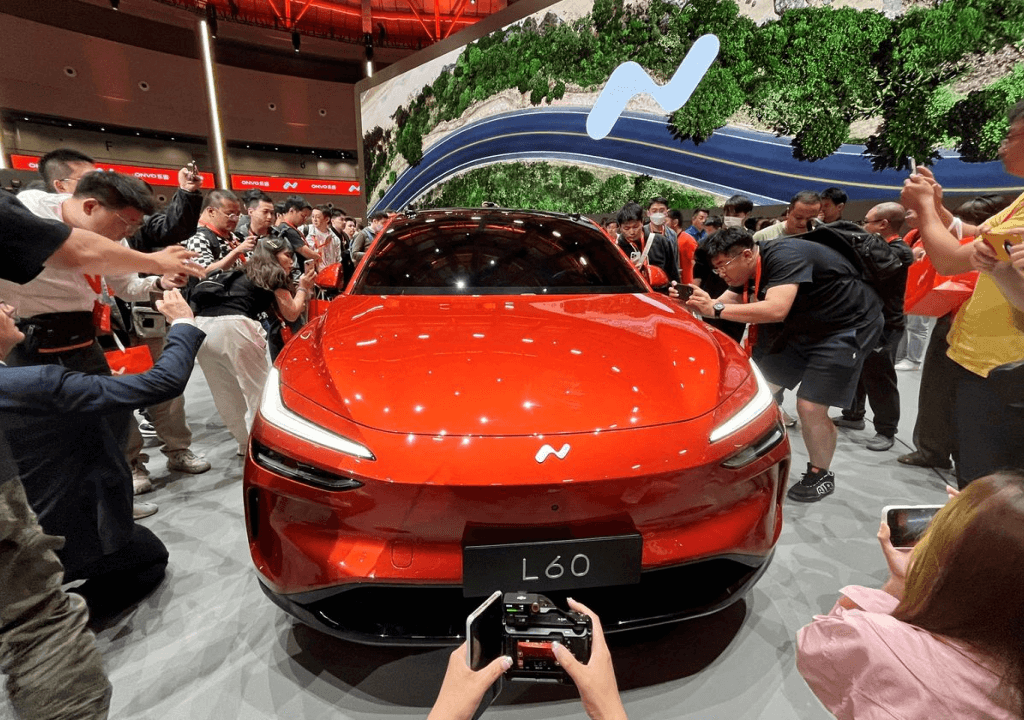

As part of initial measures that could escalate into a broader trade war, Europe is targeting the Chinese government’s subsidies to certain industries, which have resulted in cheap products with strong research and development backing. Chinese-made electric vehicles, popular among European consumers for their low prices, have benefited from these substantial subsidies. After an investigation, the European Commission found that Chinese authorities had provided extensive subsidies to electric vehicle manufacturers at every stage of production, making these cars so artificially cheap that European competitors might eventually be forced to close factories and lay off workers. By the end of October, Chinese carmakers that fail to cooperate with the EU’s investigation into electric vehicles could face tariffs of up to 36.3%, in addition to the existing 10% EU duty on cars.

For China, this is a significant setback, as the country aspires to achieve global dominance in the electric vehicle (EV) industry. In response, Chinese authorities have initiated an anti-subsidy investigation into European dairy imports. According to the China Chamber of Commerce to the EU, Beijing launched the investigation following a complaint from its dairy industry on July 29, with consultations with the EU taking place on August 14.

China’s investigation will focus on 20 subsidy programs that support the production of milk, cream, and cheese in eight EU countries, including subsidies for dairy storage, young farmers’ allowances, and supplementary income schemes under the Common Agricultural Policy. The countries targeted in the investigation include Ireland, which receives subsidies for dairy equipment, Austria and Belgium for loan schemes, Italy for livestock insurance and dairy subsidies, Croatia for livestock producer subsidies, Finland for three types of farming support, Romania for livestock subsidies, and the Czech Republic for a subsidy scheme related to farm damage. Of these, Ireland is the largest dairy exporter to China, with €423 million in sales in 2023, including dried milk for infant formula, according to Irish government data.

China’s commerce ministry announced the investigation on Wednesday, just a day after the European Commission revealed revised duties on Chinese electric vehicles as part of its investigation into what it sees as artificially cheap cars that threaten jobs in Europe’s automotive industry.

The EU Chamber of Commerce in China remarked that the investigation was expected following the EU’s actions against Chinese electric vehicle exports. It seems more investigations are on the horizon, as EU officials have also launched separate anti-dumping inquiries into other renewable industries, such as Chinese-made solar panels and wind turbines. This week, EU’s top diplomat, Josep Borrell, stressed the need to avoid a systemic confrontation with China, though he acknowledged that a trade war might be inevitable. In response, Beijing has initiated retaliatory investigations into politically sensitive European imports like pork and cognac. As with any trade war, both sides are likely to suffer, but China may be the most affected, given the current trade balance, which favors China.