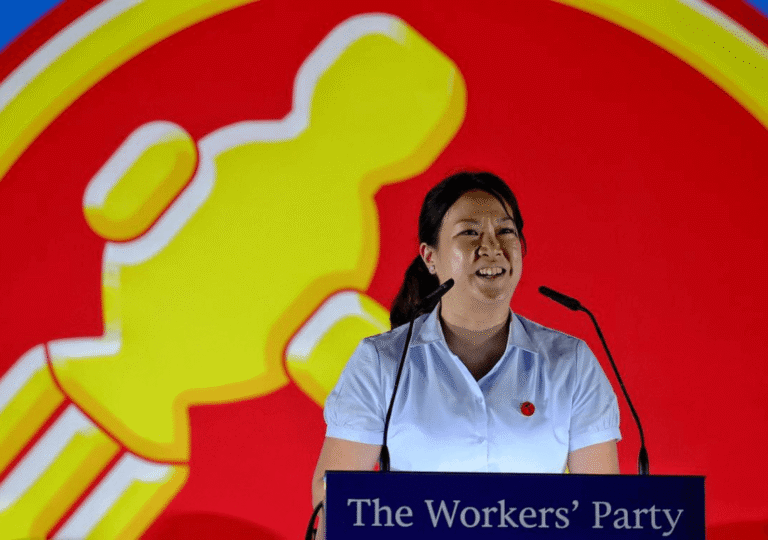

SDP Launches Petition to Overhaul Singapore Election System, Aiming for Long-Term Change

The Singapore Democratic Party (SDP) has launched a petition calling for comprehensive election system reforms as part of its new campaign ahead of the 2030 General Election.