As U.S. Pressure Mounts, Russia Moves to Secure India’s Oil Lifeline

Russia is seeking to protect its oil trade with India as the United States intensifies pressure on New Delhi.

Russia is seeking to protect its oil trade with India as the United States intensifies pressure on New Delhi.

APEC 2025 in South Korea highlighted fractures in global cooperation as the U.S. stepped back and China asserted its growing influence.

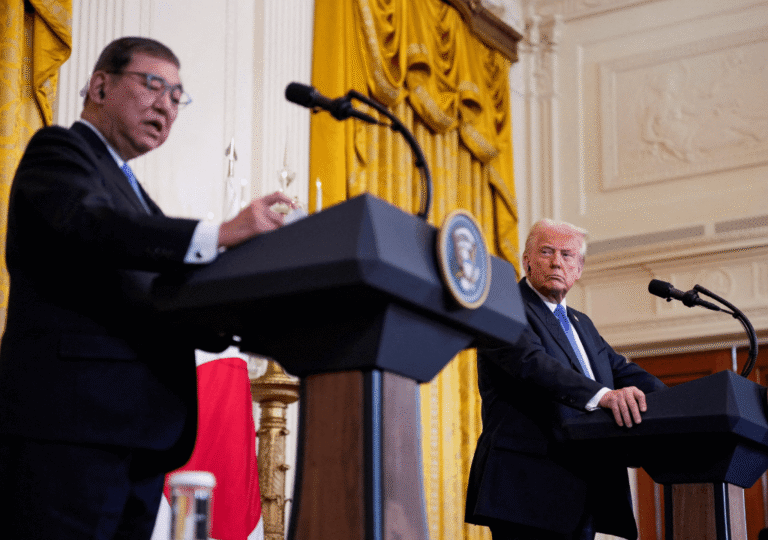

Discover how the US–Japan trade deal affects Japan’s economy, auto industry, and agriculture. Key takeaways on tariffs, exports, and political implications.

The United States is quietly rebuilding its relationship with Pakistan. From geopolitical shifts to regional security, discover why Washington sees new value in mending ties with Islamabad.

At the latest G7 finance ministers' meeting, the world’s top economies joined forces to address China’s trade practices, signaling a shift toward unity and strategic alignment.

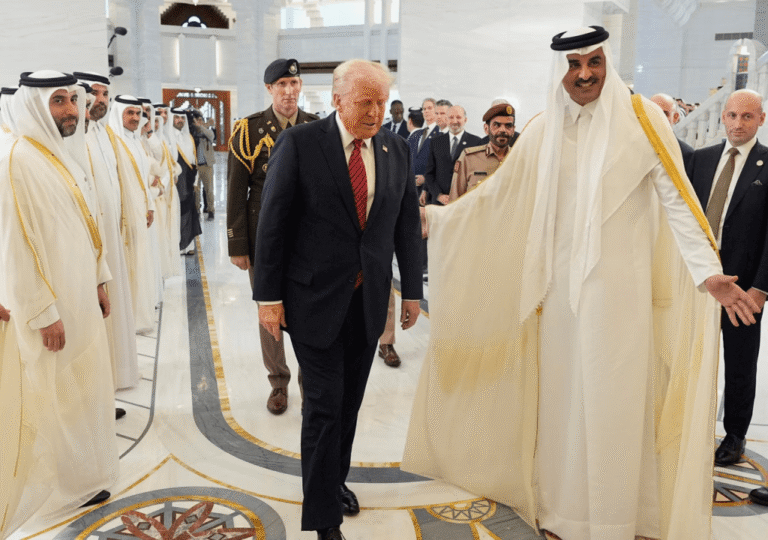

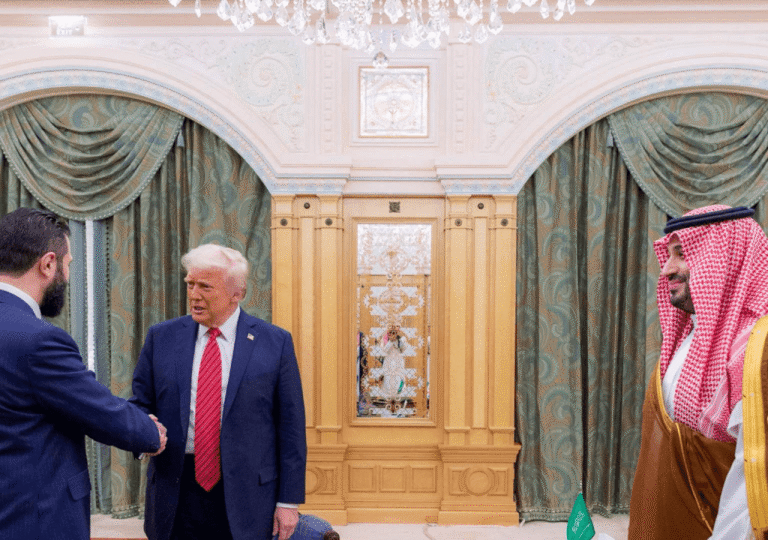

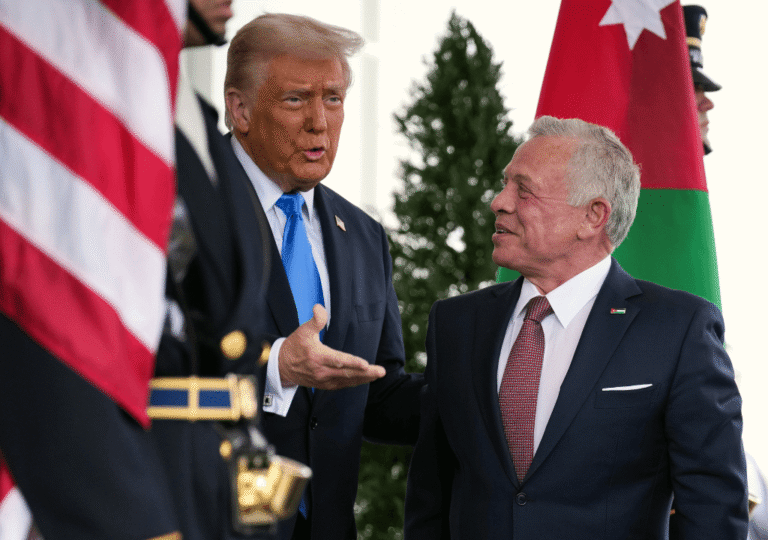

Donald Trump deepens U.S. relations with wealthy Gulf nations through high-profile arms and tech deals, positioning Saudi Arabia, the UAE, and Qatar as key strategic partners.

After lifting U.S. sanctions, Donald Trump met Syria’s new Islamist president Ahmed al-Sharaa in a high-profile summit. Explore the strategic motives and implications behind this unexpected diplomatic shift.

The US China tariff war is on pause, offering some relief to global markets. Yet behind the optimism, both sides remain wary as deeper issues go unresolved.

Trump’s and Arab counterplans for Gaza are no longer relevant as Israel moves forward with its decision to seize the territory. Discover the shifting dynamics of Gaza's future.

Explore Vietnam's evolving role in global geopolitics fifty years after the end of the war. Discover how the nation navigates shifting alliances and emerging challenges in the 21st century.