The United States and China have taken a cautious step toward defusing tensions in their prolonged trade standoff—so called “Tariff War”—by agreeing to temporarily scale back some of the punitive duties they had imposed on each other in a cycle of escalating retaliation.

Despite months of combative rhetoric, mounting pressure from businesses and consumers—already burdened by rising costs and disrupted supply chains—appears to have pushed both governments to reconsider their strategies. Confronted with growing economic uncertainty, the world’s two largest economies have agreed to resume formal negotiations, acknowledging the long-term risks posed by an entrenched US China tariff war.

The announcement sparked cautious optimism in global markets, with firms on both sides of the Pacific expressing hope that the pause could lead to more predictable and stable trade conditions.

However, while the agreement offers short-term relief, officials in Washington and Beijing concede that core disagreements remain unresolved. The road ahead is likely to be challenging, and the risk of renewed tensions persists unless deeper structural issues are meaningfully addressed in the coming months.

Trade Measures Return to Logic

The United States and China announced a joint statement on Monday, declaring a 90-day suspension of their respective tariffs and the continuation of negotiations that began over the weekend. Under the agreement, the U.S. committed to lowering tariffs on Chinese imports from 145 percent to 30 percent, while China agreed to reduce its duties on American goods from 125 percent to 10 percent.

The deal reversed many of the tariff hikes imposed since April 2—labeled “Liberation Day” by President Trump—but offered few concrete concessions beyond a mutual commitment to sustained diplomatic engagement.

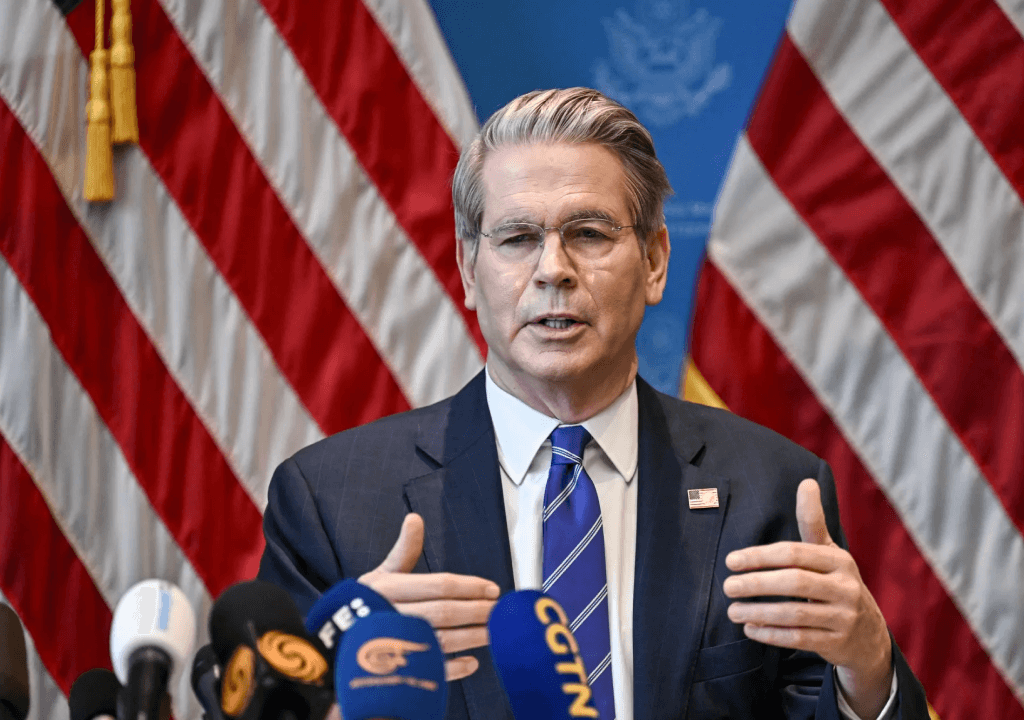

At a news conference in Geneva following the talks, Treasury Secretary Scott Bessent said both delegations acknowledged their shared interests and stressed that neither side wanted a full economic decoupling. He added that future discussions might include proposals for China to increase its purchases of American goods in an effort to reduce the U.S. trade deficit.

At the White House on Monday, President Trump acknowledged that many tariffs on Chinese products would remain in place but said upcoming discussions would prioritize expanding market access for U.S. businesses operating in China. He also mentioned plans to speak with President Xi Jinping later in the week and conceded that reaching a comprehensive agreement would require time.

Trump stressed that the United States was not trying to harm China. In response, Beijing announced it would suspend or roll back retaliatory measures previously enacted in response to U.S. tariffs, including export restrictions on rare earth elements crucial to industries such as automotive, aerospace, and semiconductors.

The Hard-Hit Tariffs

The agreement offers some relief to the frozen trade between the United States and China. Many American companies had paused orders in anticipation of a resolution that would ease the burden of crippling tariffs, which had severely disrupted logistics and effectively created a trade embargo. Treasury Secretary Scott Bessent acknowledged this, stating that the tariffs had amounted to an embargo—something neither country had intended.

Since the imposition of tariffs, China had suspended imports of several American agricultural and industrial products, including sorghum, poultry, and bonemeal, and blacklisted 27 U.S. firms—actions that significantly impacted American businesses.

On the Chinese side, factories saw a sharp decline in export orders bound for the U.S., compounding pressure on an already slowing economy. The trade war has taken a heavy toll on Chinese manufacturers and exporters, halting shipments and putting an estimated 16 million jobs at risk.

Although the tariff rollback provides a temporary reprieve, its ripple effects are likely to persist. Businesses on both sides are expected to face a surge in pent-up demand, potentially driving up shipping costs as companies rush to move goods during the 90-day negotiating window.

Nevertheless, financial markets responded positively to the announcement. Hong Kong’s benchmark index rose by 3 percent, mirroring similar gains in New York, where the S&P 500 also posted a comparable increase.

Who can claim victory in the truce?

While both sides can claim a measure of success, each is keen to take credit for forcing the other back to the negotiating table. From Beijing’s perspective, the outcome of the Geneva talks was portrayed as a strategic victory. According to a Chinese official, the government stood firm in the face of U.S. tariff pressure and gained meaningful concessions without offering major compromises.

Chinese officials have continued to denounce all tariffs, emphasizing their intent to avoid a mutually destructive trade war while also reaffirming their readiness to “Fight to the end” if provoked. A state-run English-language editorial published Tuesday described the talks as “A crucial step toward resolving differences,” but cautioned that the road ahead would be “Long-term, complex, and arduous.”

In the United States, President Trump framed the tariff war as a necessary step to correct deep-rooted trade imbalances and presented the truce as the part of a “Total Reset” of bilateral relations. Yet, despite the White House’s upbeat tone, many in the financial sector interpreted the move as a tactical retreat. Although some tariffs on Chinese goods were temporarily lifted, the joint statement conspicuously omitted several long standing American concerns, such as currency manipulation and intellectual property theft.

Instead, the administration focused on its commitment to building “A sustainable, long-term, and mutually beneficial economic and trade relationship”—a marked departure from Trump’s earlier “Liberation Day” rhetoric, when he accused foreign nations of having “Looted, pillaged, raped, and plundered” the United States.

What happens next?

With 30 percent tariffs still in place on Chinese exports and no definitive resolution in sight, uncertainty continues to cloud the broader economic landscape. The recent agreement offers little in the way of substantive detail, particularly regarding binding commitments from Beijing on currency practices and long-standing trade imbalances. The Trump administration has repeatedly accused China of unfairly subsidizing key industries and flooding global markets with artificially low-cost goods. Trump has argued that these practices have hollowed out American manufacturing and cost millions of U.S. jobs—and he is determined to fix them.

Still, both sides have returned to the negotiating table, with talks expected to continue before any new tariffs are enacted—a move widely seen as a constructive step forward.

Mark Williams, chief Asia economist at Capital Economics, described the deal as a meaningful departure from the Trump administration’s earlier hardline posture in the U.S.-China tariff war. However, he cautioned that while the truce may provide temporary relief, it offers no guarantee of a lasting solution.