The economy of the United States is its greatest asset. Instead of relying solely on its military, it utilizes the hegemony of the dollar and its economic might to forge partnerships with other countries. The United States’ financial contributions led to a West-leaning, communist-averse Europe after World War II. Similarly, it spurred the resurgence of East Asia by injecting capital and ensuring the market. The United States’ economic interests have played a significant role in mitigating full-scale conflicts in the Middle East. This strategy, centered on leveraging financial resources and markets to build alliances, is now expanding to encompass Central Asia. Central Asia, once hindered by the dominant influence of the Soviet Union and Russia, is now becoming more accessible to the United States. The US initiative in the region seeks to foster a market conducive to the prosperity of Central Asian states and to attract American investment, thereby strengthening ties with the United States.

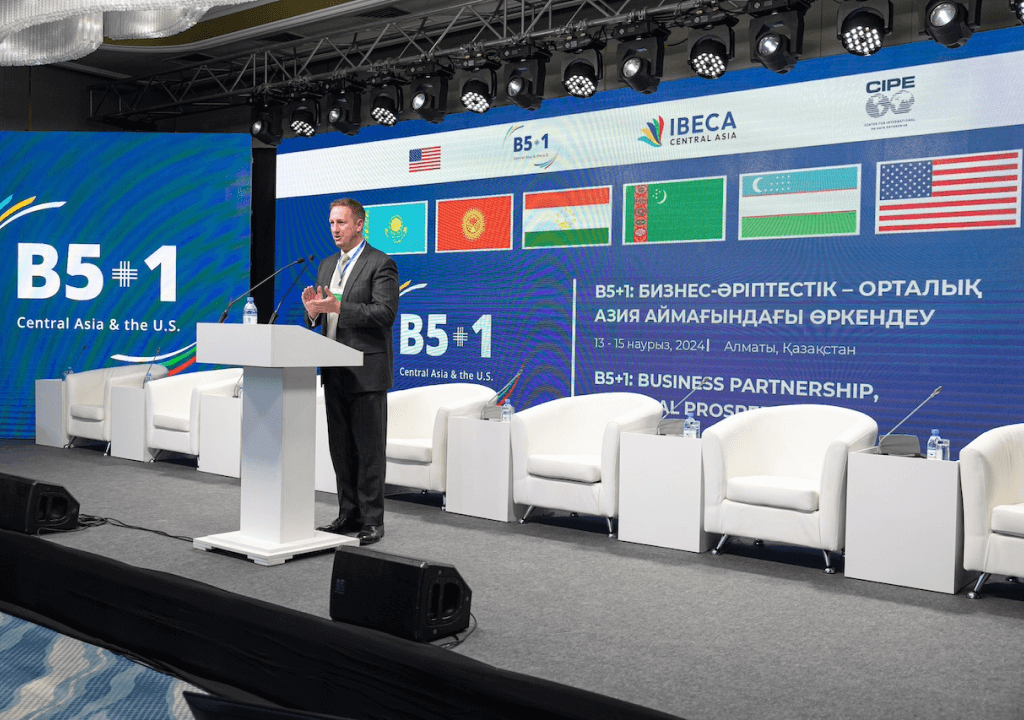

Central Asian states have long been characterized by trade barriers, bureaucratic hurdles, and regulatory complexities, greatly impeding economic progress. However, steps are currently being taken to tackle these challenges, representing a significant advancement towards creating a unified regional market similar to the streamlined documentation and policy frameworks found in Europe. Promoting the establishment of such a unified Central Asian market and facilitating smooth trade and service flow are fundamental elements of a regional economic strategy championed by the United States, known as the B5+1 initiative. Amidst a flurry of diplomatic engagements in mid-April, Central Asian leaders are actively exploring the potential of the B5+1 initiative. Launched in March, the B5+1 initiative assigns the five Central Asian nations, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, with the responsibility of spearheading efforts to promote regional free trade and enhance export opportunities.

In recent times, geopolitical analysts have turned their attention to the growing interactions among Central Asian countries, spurred by the diminishing influence of Russia and the stagnating economic growth of China . Notably, a multitude of discussions and agreements have unfolded in the region, often without the presence of Russia. A significant event occurred on April 18, when Uzbek President Shavkat Mirziyoyev and Tajik President Emomali Rahmon signed 28 interstate agreements spanning political, economic, and social realms. Noteworthy among these were two agreements aimed at bolstering trade between Uzbekistan and Tajikistan, with a focus on simplifying customs procedures at border checkpoints and safeguarding industrial property rights. Preceding Mirziyoyev’s visit, a joint investment forum in Dushanbe drew around 600 officials and business leaders from both nations. They expressed keen interest in collaborative ventures, particularly within the mining and renewable energy sectors, and sought to expand trade. Initiatives such as establishing a free trade zone at the Oybek-Fotekhobod border crossing and developing a logistics hub at Andarkhan were emphasized. Additionally, plans were unveiled to streamline permit requirements for freight-carrying trucks crossing the Tajik-Uzbek border. Despite bilateral trade reaching $505 million in 2023, officials aspire to elevate it to $2 billion in the near future. This ambition was echoed by Kazakhstan’s President Kassym-Jomart Tokayev during his agreements signing with Kyrgyz President Sadyr Japarov, underscoring the significance of facilitating cross-border movement and enhancing the exchange of manufactured goods. Subsequent to discussions with Japarov, Tokayev engaged in talks with Uzbekistan’s Mirziyoyev, likely focusing on regional trade dynamics. While details of these discussions were scarce, it was apparent that bilateral relations and regional cooperation were prioritized. However, challenges persist, notably between Tajikistan and Kyrgyzstan, where trade turnover declined significantly due to ongoing border disputes and unmarked border areas. Additionally, Turkmenistan poses a significant obstacle to efforts aimed at promoting connectivity, with issues such as a severe shortage of qualified personnel hindering international cooperation within contractual frameworks. Nonetheless, Ashgabat’s interest in expanding regional trade appears substantial, as evidenced by the sizable delegation it dispatched to the inaugural B5+1 conference in Almaty.

Recent diplomatic initiatives seem to have drawn the Kremlin’s attention, as it expresses concern that increased trade facilitation in Central Asia could lead to the expansion of commercial networks that bypass Russia. The ongoing developments aimed at streamlining trade processes in Central Asia appear to unsettle Moscow. Nevertheless, landlocked countries with tough terrain require substantial investments in infrastructure to connect with the global economy. They traditionally rely on Russia, and China made a lot of road and rail networks under the Belt and Road Initiative (BRI). It is unlikely that Russia, China, and Iran will cooperate with the trade union in this context. So the US could potentially influence countries such as Pakistan and the Southern Caucasus countries, which have aligned with European interests. These will lead to huge shifts in the entire asia geopolitical landscape. So the Impact of B5+1 will grow beyond Central Asia.