Kazakhstan, the world’s ninth-largest country, is often overlooked despite its rich history, vibrant culture, and vast natural resources. For much of its modern existence, it remained a satellite of Russia, never fully stepping into its own spotlight. Its landlocked geography and strategic vulnerabilities kept it tethered to Moscow’s influence, even after gaining independence in 1991 following the Soviet Union’s collapse. Russia continued to shape its political trajectory, limiting its ability to assert true sovereignty.

However, more than three decades after independence, Kazakhstan is now finally charting its own course. While maintaining political ties with Russia, it has strengthened its partnership with China, expanded relations with India and the Gulf states, and deepened engagement with Europe and the United States. No longer solely reliant on Moscow, Kazakhstan is leveraging its growing ties with Beijing to bolster its economic and strategic standing.

At the heart of this transformation is the Middle Corridor—a trade route linking China to Europe through Kazakhstan while bypassing Russia. This corridor has strengthened Kazakhstan’s geopolitical standing and opened new economic opportunities, firmly establishing the country as a vital hub in global trade.

The Middle Corridor

The Middle Corridor, a high-stakes trade route, provides the shortest overland link between China and Europe, sidestepping war-ravaged Russia and the increasingly congested Suez Canal. More than a mere alternative, it reflects shifting geopolitical tides and economic realignments, emerging as a transformative force in global trade. Kazakhstan’s national railway company emphasizes that the corridor not only expands regional transport capacity but also improves the speed, flexibility, and reliability of international logistics.

Beijing, driven by strategic economic ambitions, is actively expanding its access to European markets while bypassing Russia and strengthening its foothold in Central Asia by leading this project. This shift not only deprives the Kremlin of crucial transit revenue but also weakens its geopolitical leverage. As the Ukrainian news outlet Dialog notes, Chinese goods that once flowed through Russia are now shifting to these new routes—an unmistakable sign of Moscow’s declining influence over Eurasian trade. Meanwhile, rising regional powers like Kazakhstan and Turkey are positioning themselves as key players in this evolving economic landscape.

The Corridor is Filling Out

Despite Russia’s extensive transit network, a legacy of the Soviet era, the Middle Corridor still demands substantial infrastructure upgrades and investment. Yet, as its strategic importance becomes undeniable, countries along the route are accelerating efforts and channeling funds into its development.

China and Kazakhstan have officially launched a new freight rail transit line to transport Chinese goods to Europe while bypassing Russia. Additionally, China is developing two more westbound freight corridors through Kazakhstan and the Caspian Sea, further diminishing Moscow’s role as a key transit hub.

According to Kazakhstan’s State Railway company, the first container train on this route departed from Chengdu in central China on March 4, bound for the Polish city of Łódź. Carrying televisions and other electronic components, the train is expected to complete its 40-day journey through Kazakhstan, Turkmenistan, Iran, and Turkey before reaching the European Union’s border. Its success is expected to pave the way for more trains along the route.

Kazakhstan at the Center

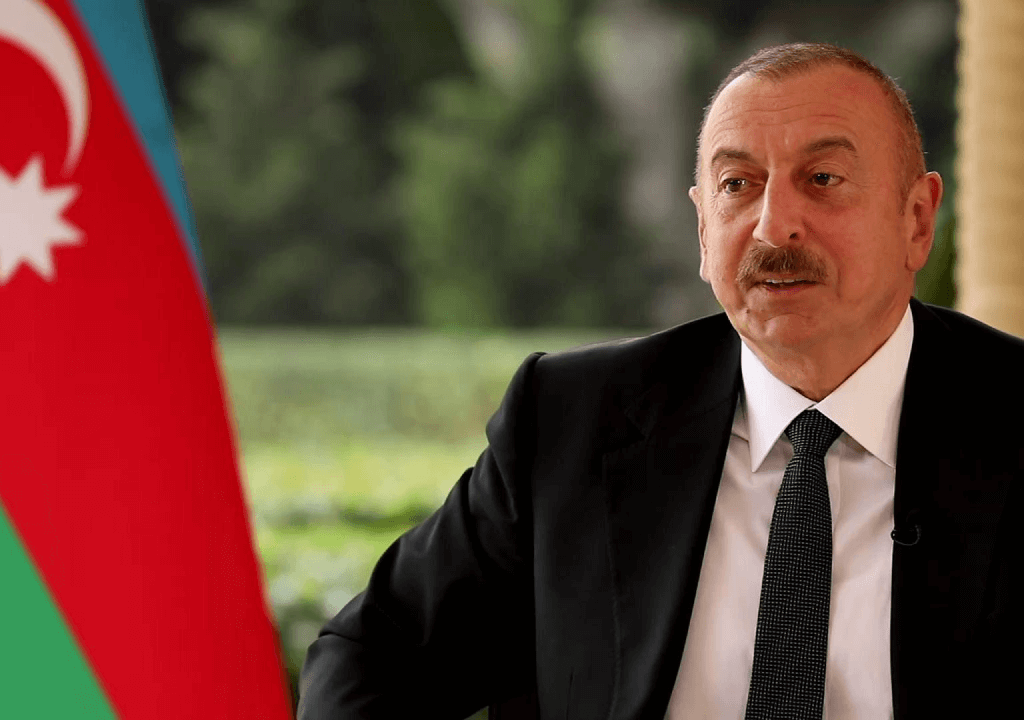

Kazakhstan has strengthened its global standing by rapidly developing its infrastructure and managing its resources more effectively. Its growing geopolitical importance has allowed it to stand more confidently before Moscow and negotiate with Russia on equal footing. Analysts point to several key moments that highlight this shift, including Kazakhstan’s neutral stance during the Azerbaijan-Russia tensions following the downing of an Azerbaijani civilian plane.

Moscow has lost its grip over land logistics between China and Europe, as Kazakhstan, China, and Turkey now control this crucial transit route. With its geopolitical influence expanding, Kazakhstan is increasingly seen as a rising power. More nations recognize its strategic importance, making it an indispensable player in regional trade and diplomacy.

Reflecting this growing influence, Uzbekistan’s state railway agency recently launched a new freight transit route connecting India to Kazakhstan. Workers loaded twelve containers onto a freighter at India’s Mundra port, sending them to Iran’s Bandar Abbas port. From there, the shipment will travel by rail through Turkmenistan and Uzbekistan before reaching its final destination near Astana, Kazakhstan’s capital. Expected to take 25 to 30 days, the new route could significantly reduce transport costs while creating more opportunities for exporters and importers.

Russia’s war in Ukraine, far from merely redrawing battle lines, has inadvertently accelerated Kazakhstan’s ascent, hastening the emergence of a more self-assured and strategically independent Central Asia.